A simple way to say I love you, a life insurance plan!

When you decide it’s time to shop for life insurance, it’s sometimes hard to know where to start. With so many companies out there saying they’ll save you money, who do you trust to ensure you’re also getting the coverage you need to care for your loved ones in the event you’re no longer here? At the Dean Ballenger Agency, we believe you deserve to understand how your policy will best preserve the plans you’ve made for your family.

Whether you’re looking for help protecting your family’s income, home, or other assets, our personalized service will focus on your needs, wants, and long-term goals. When it comes to your spouse, children, and all you hold dear, life insurance exists to care for them in the event you no longer can. When discussing life insurance options, we’ll help you consider the term policy you may need – anywhere from 10 to 30 years – and the dollar amount you want to help cover such a devastating loss. We’ll take all the time needed to help you understand and feel comfortable with the options best suited for you.

Our Advisors Don’t Work on Commission

Local Agency | Multiple Carriers | Insurance Simplified

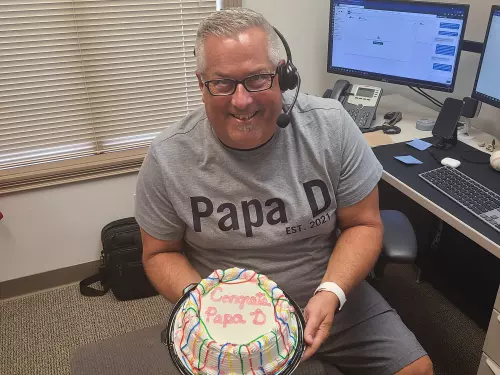

A note from Dean:

Personally, I understand the importance of having life insurance in place – I know what it’s like to experience the loss of a family member way too soon. When I was very young, we lost my father at the age of 36 and I witnessed the impact it had on my mother and my entire family. My brother Anthony passed away at the age of 10, and my sister Diana passed at age 37. As as result, I’m extremely passionate about families securing sufficient life insurance after witnessing what happens when it’s in place and when it’s not.

Several questions we’ll discuss:

- When do I need life insurance?

- What type of life insurance is best?

- How long do I need it, and how much do I need?

- Can I add more life insurance later?

- What is the best policy for me?

- Does my age matter? And what other factors matter?

- Does it cost anything to apply for life insurance?

- Will I have to take a physical, and if so — who pays for it?

- Should my spouse have life insurance if they’re a stay-at-home parent?

Want to learn more? Contact us today to set up a Life Insurance Policy.